For first-time homebuyers, the journey to homeownership is filled with excitement, anticipation, and a fair amount of anxiety. One of the most significant sources of stress and confusion is the topic of closing costs. After saving diligently for a down payment, many buyers are surprised to learn about the additional expenses required to finalize their home purchase. As a real estate agent, your ability to clearly and confidently explain these costs is crucial for building trust and ensuring a smooth transaction.

This guide will provide you with a framework for breaking down closing costs in a way that empowers, rather than overwhelms, your first-time homebuyer clients. By positioning yourself as a knowledgeable and transparent advisor, you can demystify this complex topic and guide your clients to the closing table with confidence.

What Are Closing Costs?

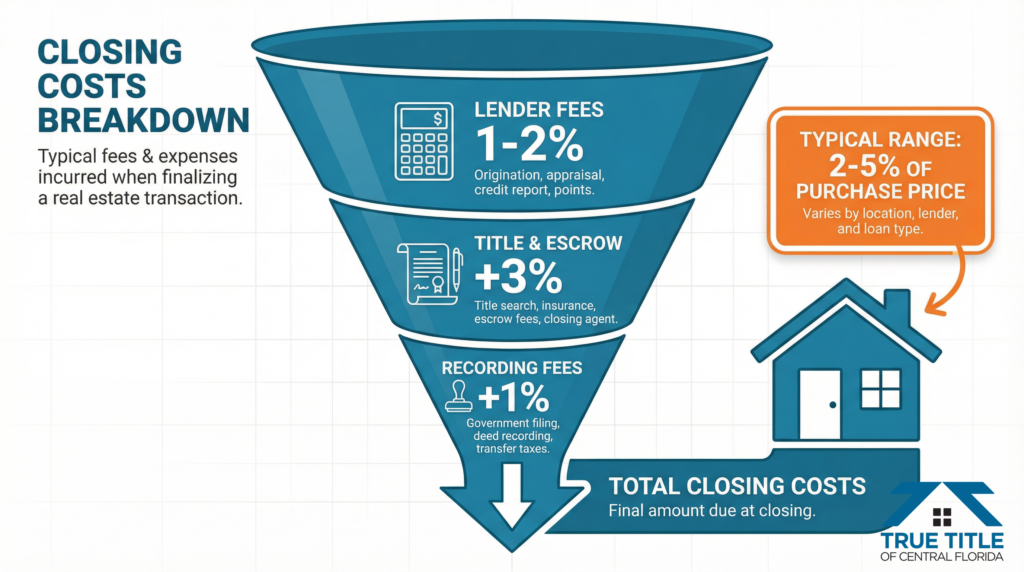

Closing costs are the fees and expenses associated with finalizing a real estate transaction. They are paid at the closing, which is the final step in the home buying process. These costs can vary significantly depending on the location of the property, the type of loan, and the terms of the purchase agreement. In Florida, closing costs typically range from 2% to 5% of the home’s purchase price.

It’s helpful to categorize closing costs into three main buckets: lender fees, third-party fees, and prepaid items.

* Lender Fees: These are the costs associated with obtaining a mortgage. They can include loan origination fees, discount points, and application fees.

* Third-Party Fees: These are fees paid to various service providers who are involved in the transaction. This can include appraisal fees, title insurance, and attorney fees.

* Prepaid Items: These are expenses that the buyer pays at closing, before they are actually due. This can include prepaid property taxes, homeowner’s insurance premiums, and mortgage interest.

A Line-by-Line Breakdown

When you present the Loan Estimate to your clients, it’s an opportunity to walk them through each line item and explain its purpose. Here’s a breakdown of some of the most common closing costs:

* Loan Origination Fee: This is a fee charged by the lender for processing the loan application. It is typically a percentage of the loan amount.

* Appraisal Fee: This is the cost of having a licensed appraiser determine the fair market value of the property. This is required by the lender to ensure that the home is worth the amount of the loan.

* Title Insurance: As we’ve discussed in previous articles, title insurance protects the buyer and lender from any unforeseen issues with the property’s title. There are separate fees for the lender’s policy and the owner’s policy.

* Homeowner’s Insurance: Lenders require buyers to have homeowner’s insurance in place at closing. The buyer will typically pay the first year’s premium in advance.

* Property Taxes: The buyer will likely need to prepay a portion of the property taxes at closing. The amount will depend on the time of year and the local tax cycle.

* Recording Fees: These are fees charged by the county to record the new deed and mortgage in the public record.

* Attorney Fees: In some cases, a real estate attorney may be involved in the transaction to review documents and provide legal advice.

Negotiable vs. Fixed Costs

It’s important for buyers to understand that not all closing costs are set in stone. Some fees are negotiable, while others are fixed. As their agent, you can help them identify which costs may be open to negotiation.

* Negotiable Costs: Lender fees, such as the origination fee and application fee, can sometimes be negotiated. Additionally, the seller may be willing to contribute to the buyer’s closing costs as part of the purchase agreement.

* Fixed Costs: Third-party fees, such as the appraisal fee and recording fees, are generally not negotiable. Property taxes and homeowner’s insurance premiums are also fixed costs.

Tools and Calculators

There are a variety of online tools and calculators that can help buyers estimate their closing costs. Encourage your clients to use these resources to get a better understanding of the potential expenses. A net sheet calculator can be particularly helpful for showing buyers a detailed breakdown of all the costs involved in the transaction.

By providing your clients with these tools, you empower them to take an active role in their financial planning. This transparency can help reduce anxiety and build confidence.

Answering Common Buyer Questions

First-time homebuyers will have a lot of questions about closing costs. Be prepared to answer them clearly and patiently. Here are some of the most common questions you may encounter:

* “Why are closing costs so high?” Explain that these fees cover the various services that are required to ensure a legal and financially sound transaction.

* “Can I roll the closing costs into my loan?” In some cases, yes. However, this will increase the loan amount and the monthly mortgage payment.

* “When will I know the exact amount of my closing costs?” The buyer will receive a Closing Disclosure at least three business days before the closing. This document will provide a final, detailed breakdown of all the costs.

Conclusion

Explaining closing costs to first-time homebuyers doesn’t have to be a confusing or stressful experience. By breaking down the costs in simple terms, providing helpful tools and resources, and patiently answering their questions, you can position yourself as a trusted advisor. This approach not only helps your clients feel more confident and prepared but also strengthens your relationship and builds a foundation for future referrals.

Ready to become a closing costs expert? Download our free net sheet calculator and start providing your clients with the clarity and confidence they need to navigate the home buying process.